All Categories

Featured

Table of Contents

Bitcoin is the biggest blockchain-based digital property. It is wildly prominent amongst cryptocurrency fanatics and speculative investors. At once, people held one of the most bitcoin as an investment. The top bitcoin capitalists are no much longer individuals due to the fact that exchanges, brokerage firms, and organizations have taken over as the largest bitcoin owners.

Bitcoin has been a company passion for years, however complying with the approval of area bitcoin ETFs in January 2024, companies represented one of the most bitcoin held. Sorts of businesses that hold bitcoin are broker agents, exchanges, business knowledge and analysis business, and equity capital groups. Initial Exchange Offerings. While not an investor in the traditional feeling, Satoshi Nakamoto, the anonymous Bitcoin designer, is reported to hold the most bitcoin.

This plan makes certain that the exchange can honor its commitment to making sure the security of its consumer's properties. Among the first companies to develop investing products related to bitcoin, Grayscale's Bitcoin Trust fund ETF (GBTC) is just one of the most popular bitcoin financial investments besides bitcoin itself. On May 8, the ETF held 292,267.9983 BTC, allowing capitalists direct access to price adjustments.

Privacy Coins: A Deep Dive Into Their Benefits And Risks

MicroStrategy continues purchasing bitcoin and held an overall of concerning 214,400 bitcoins in May 2024. Services are the biggest bitcoin capitalists in 2024.

Bitcoin and cryptocurrencies are unstable financial investments however many individuals invest heavily in them, wishing they will certainly proceed surpassing previous highs and return a neat earnings. While spending in bitcoin and other cryptos can be testing for investors strange with the crypto world, new methods of spending in bitcoin and various other cryptos have arised, mainly in the kind of exchange-traded funds (ETFs).

The comments, opinions, and analyses expressed on Investopedia are for informational objectives only. As of the day this short article was composed, the writer possesses BTC and LTC.

Bitcoin started with a value of less than a dime, and at its historic high hit more than $73,000. Considering that its beginning, more than 21,000 different cryptocurrencies have actually advanced and complied with in Bitcoin's footsteps.

How To Protect Your Crypto Assets From Cyber Attacks

Ballot rights are additionally issued with these symbols with the blockchain. Tesla and PayPal are simply 2 examples of companies that can be acquired as routine shares and as tokenized supplies with the blockchain.

Bitcoin was meant to eliminate the control, oversight and charges connected with cash transactions. The initial real purchase with Bitcoin took area on May 22, 2010, when a Florida man bargained to have 2 Papa John's pizzas worth $25 provided in exchange for 10,000 bitcoins.

Since Bitcoin's inception, more than 21,000 various cryptocurrencies have been developed. Bitcoin is the most valuable coin in circulation, with Ethereum and Tether in 2nd and third area, specifically.

The Future Of Decentralized Autonomous Organizations (Daos)

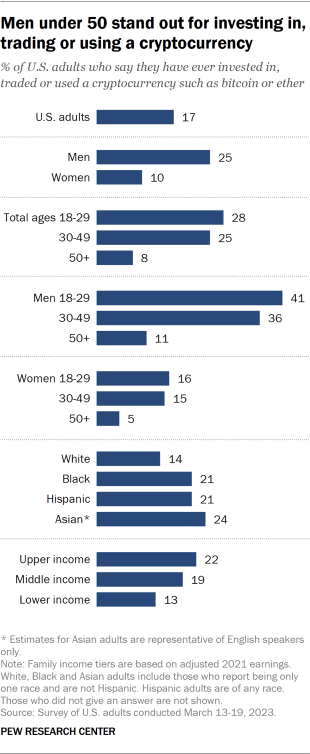

4, 2024), according to The international repayments revenue is expected to cover $3 trillion by 2026, according to a McKinsey record. As of Sept. 4, 2024, the size of the Bitcoin blockchain is roughly 598 gigabytes, regarding 18 percent greater than where it was one year back. Concerning 17 percent of American adults have actually possessed cryptocurrency as of 2023, according to a Seat Proving ground survey.

This ledger tracks each transaction of cryptocurrency, and computers throughout the network verify and process each deal via a blockchain data source. Believe of it like a lengthy receipt that tapes every purchase in a cryptocurrency.

When cryptocurrencies were very first created, it was almost difficult for government tax obligation companies to track them. The characteristic of blockchain purchases is anonymity, indicating one might not verify the identity of the buyer or the vendor. In 2014, the internal revenue service mentioned that cryptocurrency was to be treated as home for government income tax purposes.

How To Get Started With Cryptocurrency Investing

Game streaming platform Twitch approves Bitcoin, Bitcoin Money and others as settlement. AMC movie theaters enable spectators to buy tickets with Bitcoin and other cryptos.

Crypto mining is the procedure of creating new coins on a provided blockchain such as Bitcoin's. Computers operating these decentralized blockchain networks address complex mathematical issues to attempt to earn bitcoins. These high-powered computer systems contend with each other to resolve the troubles in the hope that they are compensated with the bitcoins up for grabs.

Here are additional details right into how all of it works. Traders can purchase cryptocurrency at several places nowadays, including traditional repayment apps such as PayPal and Venmo, spending applications such as Robinhood and Webull, crypto exchanges such as Coinbase along with a few conventional brokerage firms such as Interactive Brokers. If you're aiming to acquire crypto, right here are several of the leading exchanges and apps to take into consideration.

We believe that cryptocurrencies and blockchain modern technology will reinvent and reinvent several sectors, consisting of the economic one. You can currently utilize various symbols and coins for different utilities like buying food, buildings, and travel expenditures. With that said in mind, it has actually to be said that this is still a young industry which a lot of people are in it purely for speculative investments.

The Role Of Proof Of Stake In Crypto Security

They probably listened to about Bitcoin in one of the most current bull markets, especially at the end of 2017. They tend to do not have the specific expertise and experience, which is why they can often be naive.

If they are fortunate and make an effective investment, they obtain extremely confident. If the market makes a recession, they obtain extremely downhearted. Basically, their feelings towards cryptocurrencies fluctuate in rhythm with market problems. No one should spend more than they can afford to shed, and this is especially real for newbies.

Latest Posts

Top Altcoins With High Growth Potential In 2024

The Benefits Of Decentralized Apps (Dapps) In Crypto

Best Crypto Projects For Long-term Growth